EU in Turmoil and not only in Financial One

The

two dominating trends among EU leaders are to cut losses of players in

virtual economy at the expense of taxpayers and to guide EU towards

strict federation at the expense of democracy.

(Ari Rusila)

The

financial crisis has been in headlines already few years. Despite

continuous emergency meetings between EU and especially Eurozone

countries no light can be seen for better future. Despite more and more

”effective” measures the markets are not satisfied more than few hours

or days. In my opinion it is time finally admit that selected strategy

to save euro has been disaster - not maybe to banks and speculators but

to ordinary citizens at least. It is time to make alternative visions

not only for Euro but for whole EU too, time to whistle game out,

collect losses and start new game in Day after Euro/EU context.

The

financial crisis has been in headlines already few years. Despite

continuous emergency meetings between EU and especially Eurozone

countries no light can be seen for better future. Despite more and more

”effective” measures the markets are not satisfied more than few hours

or days. In my opinion it is time finally admit that selected strategy

to save euro has been disaster - not maybe to banks and speculators but

to ordinary citizens at least. It is time to make alternative visions

not only for Euro but for whole EU too, time to whistle game out,

collect losses and start new game in Day after Euro/EU context.Today strategic decisions are hard to agree due 27 different circumstances in 27 member-states (and more to come with enlargement). Also “European Monetary Union” is dead as economies inside Eurozone differ too much. It would seem nowadays that the Eurozone leaders have decided to place the region under Martial law. Old principles about democracy, subsidiarity etc are forgotten.

From

my viewpoint intervene again and again into something that is not going

to work in the long run is the wrong medicine. The two dominating

trends among EU leaders are to cut losses of players in virtual economy

at the expense of taxpayers and to guide EU towards strict federation at

the expense of democracy. Change to this is needed for saving 99 % of

people instead saving profits of the rest one per cent.

Eurozone countries have tried solve financial crisis in Greece with different measures – such as bailout packets – already few years with about € 320 billion. However this amazing solidarity of Eurozone has not helped average Greek. Instead foreign banks and financial speculators have been beneficiaries of the aid money. The still ruling government in Greece has also decided to invest aid money to new submarines and other military equipments instead the needs of their citizens. Btw as Nato country why Greece does not apply same strategy like Iceland who has outsourced e.g their military air-control to other member-states. Anyway on the bottom line Greece had public debts on 2009 some €300 bn and after aid packets it now has €420 bn . GNP is decreasing so debt problem is coming more difficult to solve every day. Same time the living conditions of average citizens has dropped dramatically and extra loans have not made ground for new entrepreneurship or new export business or helped still existing companies. When unemployment is rising the share of debt compared to GNP doing the same. (See e.g. ”Common Appeal for the Rescue of the Peoples of Europe” )

Euro-zone, European Central Bank and IMF seem to have only one ultra-liberalist strategy to solve problem – cutting salary, public services and social benefits from ordinary citizens and saving some financial institutions, funds and speculators from bigger losses. But the problem will not be solved with this strategy and the reason is that these financial institutions and speculators have created a virtual financial world ( derivative markets, futures, hedge-funds ...) which value is about ten times more than the real economy. I am not an economist but anyway how could this equation be solved with selected strategy.

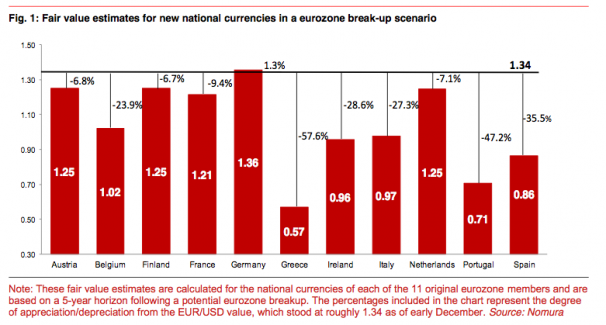

Grexit now would be best for all. The new currency should be introduced at a one-for-one rate with the euro. But it will soon depreciate by something like 30-50% giving a boost to Greece's international competitiveness. The government should renominate its debt in the new national currency and make clear its intention to renegotiate the terms of this debt.

Different analysts estimate that the overall debt load continues to grow faster than the economy, then large-scale debt restructuring becomes inevitable. Greece has been in a state of slow motion economic collapse on the scale of past economic collapses such as that of Argentina but so far without the ability to default, devalue and inflate. It is to be noted that the case of Argentina shows one successful example how to copy in a similar situation.

Strategic miscalculation

"The euro should now be recognized as an experiment that failed"

(Martin Feldstein, an American economist in 2012)

There

are clear advantages to ridding Europe of the euro. Countries now

suffering with debt could return to their national currencies, devalue,

and regain competitiveness more easily. They wouldn’t have the same

financial safety-net – at Eurozone level - but their freedom would also

allow them to chart their own course. The poor outsiders could negotiate

debt restructurings and a more fair division of losses would result and

same time the rich outsiders could probably put their economies on a

stronger growth path by using their money for supporting investments in

real economy of their country instead supporting saving efforts of

speculator money in virtual economy.

One viewpoint is that the debt should be characterized as odious debt.

This definition is famous earlier from cases in South America and

Africa uder military dictatorship. For example the Greek documentary Debtocracy examines whether the recent Siemens scandal

and uncommercial ECB loans which were conditional on the purchase of

military aircraft and submarines are evidence that the loans amount to

odious debt and that an audit would result in invalidation of a large

amount of the debt. (See more e.g. Liège based NGO Committee for the Abolition of the Third World Debt /CADTM)EU Scenario: Dissolution, Federation, Confederation, EU Lite ...

”A

lot of English people like the economic advantages, but are happy to

keep the frogs and krauts and spics and eye-ties at a healthy distance.”

(One view from U.K. in web)

Now

Eurozone as well EU as construction is on the verge of tumbling down.

EU bureaucracy is implementing their only truth by trying to guide EU

towards federation. Earlier agreements in Maastricht, Barcelona and

Lisbon were only soft exercises. Now financial crisis has enabled

stronger methods. In March 2011 a new reform of the Stability and Growth Pact

was initiated, which provides for automatic penalties and obligations

for states in case of breaches of either the deficit or the debt rules.

By the end of the year, Germany, France and some other smaller EU

countries went a step further and vowed to create a fiscal union across the Eurozone with strict and enforceable fiscal rules and automatic penalties embedded in the EU treaties. (More e.g. Wikipedia).

Now

Eurozone as well EU as construction is on the verge of tumbling down.

EU bureaucracy is implementing their only truth by trying to guide EU

towards federation. Earlier agreements in Maastricht, Barcelona and

Lisbon were only soft exercises. Now financial crisis has enabled

stronger methods. In March 2011 a new reform of the Stability and Growth Pact

was initiated, which provides for automatic penalties and obligations

for states in case of breaches of either the deficit or the debt rules.

By the end of the year, Germany, France and some other smaller EU

countries went a step further and vowed to create a fiscal union across the Eurozone with strict and enforceable fiscal rules and automatic penalties embedded in the EU treaties. (More e.g. Wikipedia).

With

the "golden rule" the Stability and Growth Pact, the political choices

of national parliaments are limited. Besides killing the democracy the

Pact will kill growth too so putting people in misery and dismay. The

Pact is new tool for the plundering of the public services and the

destruction of social rights in all EU countries.

The

best scenario from my point of view could be some kind of EU Lite

version. A bit of similar ”privileged partnership” agreement than planed

with Turkey. EU Lite should be build simply to EU's early basics as

economical cooperation area including a customs union, the EU tariff

band, competition etc linked to idea of the Common Market. EU Lite could

also apply a structure of Confederation. Also some kind of fiscal

confederation can be shaped. EU Lite could be described also as a

political union and there could be some forum for national

parliamentarians and party leaders. Federalist intentions, the EU puppet

parliament and the most of EU bureaucracy should from my point of view

put in litter basket together with high-flown statements and other

nonsense.  The

investors face normally e.g Interest rate risk, credit (i.e default)

risk, volatility risk, structure risk, counter-party credit risk,

prepayment risk, general market risk, liquidity risk, extension risk,

transparency risk, political risk, and currency risk and now also with

Euro a dissolution risk. As said this is normal and because of those

risks also the profits are huge. But the basic principle in is that with

investments and not to speak even speculations there is two sides –

wins and losses. In my opinion the loss should no more be paid by

taxpayers.

The

investors face normally e.g Interest rate risk, credit (i.e default)

risk, volatility risk, structure risk, counter-party credit risk,

prepayment risk, general market risk, liquidity risk, extension risk,

transparency risk, political risk, and currency risk and now also with

Euro a dissolution risk. As said this is normal and because of those

risks also the profits are huge. But the basic principle in is that with

investments and not to speak even speculations there is two sides –

wins and losses. In my opinion the loss should no more be paid by

taxpayers.Many – still non-member - Balkan countries, Turkey and one disputed region (Kosovo) have some vision about EU association. While considering this in my opinion three aspects should be highlighted:

Why to join? Due the needs of people or due the needs of Brussels or elite?

When related to time-line? Association process is long and circumstances are changing, after EU/Eurozone crisis who know what kind of EU if any still exists, same time other regional and global power-centers are rising and options should be open.

Where? Now it is open question if country is joining in future to strict federation with martial law, to some sub-category of loose federation, confederation, open discussion forum or free trade zone only.

After this the forth question – how – is the easy one. (More this with example of Serbia in Serbia’s EU association is not a Must )

My bottom line

With today's strategy there is a risk that the combination of economic insecurity and political paralysis has been recipe for an increase in extremism and xenophobia. It is slow motion death spiral of economic collapse. That is the base to my view that people should be the first priority and not virtual economy, fiscal system, euro or even EU.

I would like to see following principles – related to current Eurozone crisis - to came again to agenda:

- People first system after

- Real economy instead of virtual economy

- Investor risk instead of taxpayers risk

As

interests even inside Eurozone differ these new principles in my

opinion have best change if implemented at national level. So e.g each

country could nationalize their bankrupting banks, each country could

start implement Toby'n (or transaction) tax by national decisions. And

when different countries find common interests so new formations, forums

and cooperation can be established.

Comments