EU’s big choice – Nabucco or South Stream?

Despite the efforts to save energy a strong scenario for near future is that the quantity of gas needed in EU region will remain same as today if not bigger. sources of gas are widely known the essential question is how the gas is arriving to European markets. Environmental and technical aspects can be handled as well economical ones; the real battlefield is (geo) political and it’s much more effective than energy issue itself.

Despite the efforts to save energy a strong scenario for near future is that the quantity of gas needed in EU region will remain same as today if not bigger. sources of gas are widely known the essential question is how the gas is arriving to European markets. Environmental and technical aspects can be handled as well economical ones; the real battlefield is (geo) political and it’s much more effective than energy issue itself.

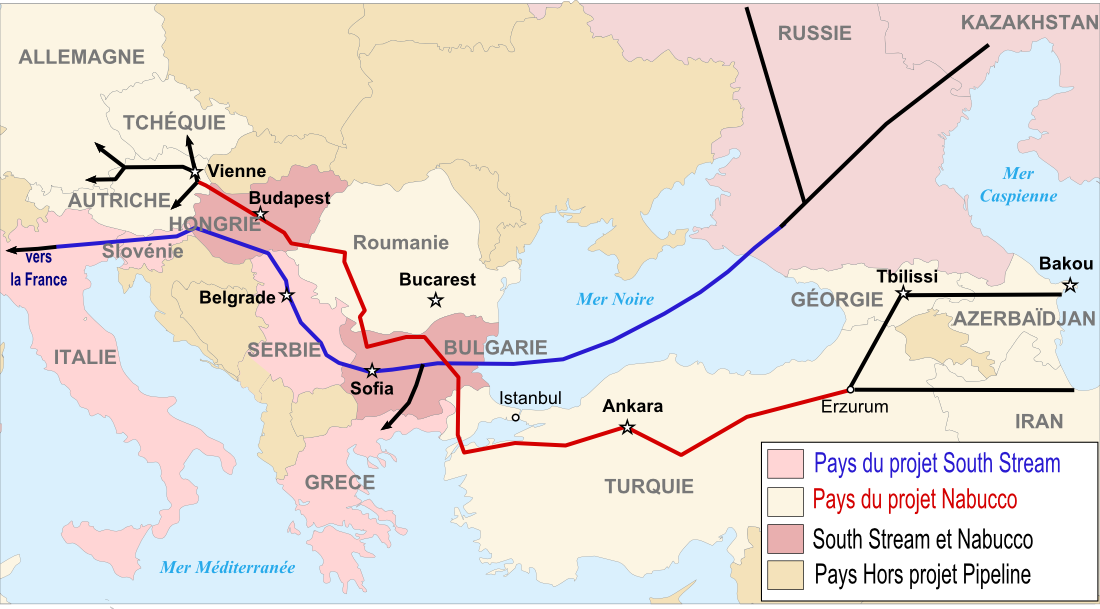

In today’s Europe the core of energy war is the struggle between South Stream and Nabucco pipe lines, which also is one of the most divisive issue inside EU. The Brussels bureaucracy favour the Nabucco project, a transit route bypassing both Russia and Ukraine, while a part of EU member states, EU energy giants and gas producers are favouring Russia’s South Stream.

Latest developments

EU, Russia as well companies interested about gas business have all activated when decisions are needed to define the final route of gas to European markets.

a) EU

The common factor with both pipelines is that they are eliminating Ukraine’s transit monopoly. Publicly EU has probably due political motives planned update Ukraine’s gas pipeline network like during The International Investment Conference on March 23rd 2009 in Brussels. Russia has not been invited to discuss the terms of gas supplies to Europe via Ukraine's gas pipeline network for three years but Ukraine is hoping part of requested $5.5 bn modernization costs from EU in name of EU energy security. Gas buyers and transit operators may have their views, but the question still remains what they can buy and on which terms. EU bureaucrats are making a fatal miscalculation if they are building energy infrastructure without source of energy itself.

The EU Commission has included the Nabucco pipeline in its list of priority projects, despite pressure from Germany and Italy. But the EU cut its budget funding of the project by 20% getting some 200 million euros for first stage of the project.Nabucco is likely to rely heavily on subsidies from the EU. Several member countries questioned the economics of the project.

The European Union and Turkey gave fresh political impetus on 8thMay 2009 in Prague to the Nabucco pipeline project, although key Central Asian gas suppliers held off on pledging their support. But it also needs gas, which may be a problem as Kazakhstan, Uzbekistan and Turkmenistan refused to sign the final declaration in Prague, unlike two other suppliers -- Azerbaijan and Egypt -- and two key transit nations -- Turkey and Georgia. But Mr Gul also made clear he expected some progress on Turkey's stalled EU membership talks. Earlier Turkey’s premier, in a rare visit to Brussels on January 19, tested Europe’s reaction, saying that he will review his support for Nabucco if the Energy Chapter of its EU accession talks is blocked. “If we are faced with a situation where the energy chapter is blocked, we would of course review our position,” he said. (Neweurope 26 January 2009) The Declaration of Southern Corridor Summit here .

b) Russia

Russia has floated plans for a new global treaty on trade in fossil and nuclear fuel in an attempt to consign to history an earlier pact, the 1991 Energy Charter Treaty. Russian President Dmitry Medvedev unveiled the project during his state visit in Finland on 20th April 209. "Our task today is to maintain, or rather ensure for the future, the balance of producers of energy resources, transit states and consumers of energy resources," he said. The new pact is to cover oil, gas, nuclear fuel, coal and electricity and to include the US, China and India as well as European countries.

On 15th May 2009 four agreements shall be signed in Sochi: the national companies of Serbia, , Bulgaria and Italy shall sign agreement with the Russian ‘Gazprom. One of them is agreement between Serbia’s Srbijagas and Russia’s Gazprom on route of Southern Stream pipeline through Serbia with length about 450 kilometers. There shall be also a fifth agreement – bilateral agreement between Russia and Italy, which shall be signed by the Prime Ministers of the two countries, Vladimir Putin and Silvio Berlusconi. (Blic 13.5.2009)

c) Companies

The consortium behind the Nabucco now comprises six national energy companies: Botas (Turkey), Bulgargaz (Bulgaria), Transgaz (Romania), MOL (Hungary), OMV (Austria), and RWE (Germany). However on Jan. 25, 2008 OMV sealed a deal for a joint venture with Gazprom for extending Baumgarten’s storage and distribution capacity. Accordingly, Gazprom holds a 50 percent stake there. Moreover, OMV has been buying into Hungary’s MOL. Considering Russia’s significant share in OMV, any amount of OMV ownership of MOL again translates into stakes for Russia’s energy giant. Even further challenging the Nabucco project is the fact that OMV and MOL, together with yet a third consortium member, Bulgargaz, have already signed up to Gazprom’s South Stream project.

Nabucco

The pipeline that the EU hopes will bring gas from the Caspian Sea to Austria takes its name from Giuseppe Verdi's 1842 opera, Nabucco. The work tells the story of the oppression and exile of Hebrew slaves by Nabucco, a Babylonian king, better known to the English world as Nebuchadnezzar. The opera deals with the eternal quest for freedom, but the choice of name may yet prove fateful for a project that is facing so many obstacles to its completion.

The pipeline is supposed to transport around 30 billion cubic meters of gas annually. In terms of gas suppliers the project's backers have named Iran, Iraq, Azerbaijan and Turkmenistan.

However Turkmenistan's gas output is contracted to Russia up until 2028. Azerbaitzan also does not have the amounts required so as for the project to be profitable in the long run. The possibility of Iranian gas is far from realistic due to its nuclear program and the adamant denial by Israel and the opponent Sunni Arab states. Nabucco is still counting on gas supplies from Azerbaijan despite a memorandum of understanding signed between Russia’s Gazprom and the State Oil Company of Azerbaijan SOCAR signed on March 30th 2009 clearly shows the growing interest of Azerbaijan in cooperation with Russia.

32 European countries are clients of Russia’s Gazprom. Despite EU declarations and investment plans the US-backed Nabucco natural gas pipeline is dying a slow death. Even its strongest supporters have a hard time demonstrating its commercial viability. The risk for Nabucco is that if the supply and funding issues are not sorted out, the EU's dream of energy freedom will remain an aspiration rather than a reality.

South Stream

Its planned route would run from the Russian Black Sea coast across the seabed to Bulgaria, then bifurcate into a southern branch to Greece and southern Italy and a northern branch into Serbia, Hungary, and Austria, with a potential detour to Slovenia and northern Italy.

Bulgaria and Hungary have both signed government agreements on joining South Stream. Austria is also in talks and has already agreed to sell Gazprom 50 percent of the shares in Baumgarten, the gas hub where Nabucco is supposed to end, while Turkey already operates a direct sub-marine pipeline linking it to Russia - Blue Stream. Also Romania is open to investing in the Gazprom pipeline South Stream, not just the EU Nabucco project.

On December 2008, Russia and Serbia signed an umbrella agreement providing political guarantees that Serbia will receive a stretch of the South Stream gas pipeline and that the underground gas storage facility in Banatski Dvor will be finalized. At the same time a 51 % stake of Serbian Oil Industry (NIS) was sold to Gazprom.Slovenia backed South Stream gas pipeline in the midst of a European gas crisis Jan. 2009 while Gazprom tried to secure pledges on the South Stream gas pipeline to Italy. The Slovenian delegation said during the meeting the implementation of the South Stream project would both diversify the European energy sector and allow Russia to transit its gas without obstacles. A portion of the pipeline would travel through Serbia and Hungary with options to include a leg through Slovenia to northern Italy.

In September 2008, Uzbekistan and Russia agreed to build a new pipeline with a capacity of 26 to 30 billion cubic meters (bcm) annually to pump Uzbek and Turkmen gas to Europe. Such a pipeline will again undermine the US efforts to pump trans-Caspian energy routes bypassing Russia.

The technical and economic assessment of the land where the pipeline will lie is planned to be completed by the end of 2009, while the assessment of facility's underground stretches should be finished in early 2010. Russia's Gazprom plans to start gas deliveries to Europe through the future South Stream pipeline no later than 2015.

Iran

However, the whole situation is good for Iran. Some experts believe that without Iran the “Nabucco” project will remain unimplemented, while its participation could give an impulse to the process. Iran has the largest gas reserves in the world after Russia and Turkmenistan (27,5 trillion cubic meters, or 18% of the world's gas reserves and 33% of that of the OPEC).

But is there gas coming from Iran? Iran uses the lion's share of produced gas (360 million cubic meters daily) for civil purposes. By the year 2014 Tehran plans to provide gas to 93% of the population of 630 cities and to 18% of the rural population in more than 4,000 villages. Iran's factories and electric power plants also need much gas. Another share of the produced gas Iran has to inject into its reserves to keep oil production at a high level (experts say this help Iran increase output by more than 30%). Iran has long been enjoying infrastructure for oil exports but yet has not such for exporting gas.

On February 21st 2009 the Iranian and Turkmeni governments signed an agreement that will give Iran the rights to develop the Yolotan gas field in Turkmenistan. The deal will help Iran resolve gas supply problems in its north-eastern provinces. Turkmenistan will sell Iran an additional 350 billion cubic feet of gas annually, more than doubling current supplies of almost 300 bcf a year, according to the agreement first disclosed by Iran’s official media and later confirmed by Turkmenistan.

Iran also recently offered to invest $1.7 billion for a 10 percent stake in the second phase of Azerbaijan’s huge Shah-Deniz gas field which will come on line by 2014. Iran already has a 10 percent share in the first phase and it wants to import large volumes of gas from the Azeri field. For Iran, the deals couldn’t be better suited to its objectives. It’s economically unviable currently to supply gas to its isolated, north-eastern third of the country. Getting gas from Turkmenistan would therefore make more Iranian gas available for export to Turkey. Also, connecting both Caspian countries to Iran via pipeline would allow Tehran to accomplish its long-held objective of transiting any gas production increases from its neighbours to customers in Europe, the Persian Gulf, or Asia.

Turkmenistan

Preliminary indications are the gas reserves in Turkmenistan is around 38.4 TCM – far more than Iran and just 20% lower than Russia. The biggest gas field discovery was in October 2008 – called the Yoloten Osman deposits. It is located near the Afghan – Turkmenistan border. Turkmenistan has contracts to supply Russia with 50 bcm annually, China with 40 bcm and Iran with 8 bcm annually. The Russian energy giant Gazprom requires this Turkmen gas to meet its export obligations in the European market, which accounts for 70% of the its total revenue. Gazprom sells 2/3 of Russia’s 550 bcm annual gas production in the rapidly growing domestic market. This compels it to secure Turkmen supplies to meet contracted European demands.

Nabucco vs. South Stream

Gazprom has received an invitation to join the Nabucco pipeline project to pump gas from Central Asia to Europe, but will not take up the offer, a deputy head of Russia’s energy giant said. In an interview with Vesti TV on Monday, Alexander Medvedev said Gazprom would stick with its South Stream project and stay out of Nabucco. “Unlike in the case of Nabucco, we have everything we need for this project [South Stream] to materialize,” he said. “We have gas, the market, experience in implementing complex projects, and corporate management.”

The Nabucco route does circumvent Ukraine, but it is from Turkmenistan and Kazakhstan, goes under Caspian Sea, passes across Azerbaijan, Turkey, and Georgia. So many countries in pipeline are creating multiple political risk compared to South Stream which goes from Russia under Black Sea directly to EU zone. Besides, Nabucco is going to lack the resource base adequate to its transit capacities unless the project is joined, for example, by Iran, but this is politically problematic.

The shareholders of the Nabucco consortium are: Botas (Turkey), Bulgargaz (Bulgaria), MOL (Hungary), OMV(Austria), RWE(Germany) and Transgaz (Romania). OMV, MOL and Bulgargaz have also signed up to South Stream pipeline, which bypasses Turkey. It is unrealistic to think that both South Stream and Nabucco will happen, but companies want to make sure at least one of them happens and be part of that.

The current timeframe, assuming that the outstanding issues are resolved, is that Nabucco would come on-stream in 2013, two years after Nord Stream, the planned Baltic pipeline, which has already secured both supplies and finance for the construction work.

Some geopolitical aspects

The EU's new "southern corridor" has been dubbed a version of U.S. "Silk Road Strategy" aimed to block Russia from gas fields around Caspian Sea and its connection to Iran (More in my article "Is GUUAM dead?). The South Pars natural gas field brings a new element to change original U.S. plan as it is a sign of a long-term energy alliance between Moscow and Tehran and with active participation of the EU. Turkey and Armenia may be join the project as transit countries. Naturally, this leaves Washington very few chances to lobby its energy projects in the region aimed at using Azerbaijan and Georgia as the so-called 'Caucasus communication corridor'.

In addition Russia, Iran and Qatar have taken the decision to form a "big gas troika". The idea is that three countries - with 60 % of global gas reserves - will work on joint projects accross the entire gas chain from geological exploration and production to distributionand marketing gas. Alexey Miller – Head of Gazprom - stated at the end the meeting that “we are united by the world’s largest gas reserves, common strategic interests and, which is very important, high potential for cooperation within tripartite projects.

There is also a question about Turkey. The South Stream pipeline will run from Russia directly to Bulgaria across the Black Sea. Russia is diversifying its gas supply routes so as not to depend on one transport hub. It might perhaps be cheaper to build the new pipeline along existing route of the Blue Stream, which crosses the Black Sea from Russia to Turkey, than to lay a new route on the seabed. This, however, would increase the aggregate capacity of the two streams to about 48 billion cubic meters, giving the Turks a great deal of influence on Russian supplies.Russia and the EU countries do not want this to happen. On the other side Greece, which is taking part in the construction of an oil pipeline from Burgas in Bulgaria to Alexandroupolis, has announced its readiness to join the South Stream project. This makes sense, as apart from bringing economic dividends it will make Greece an international energy hub on a par with Turkey.

Bottom line

In conclusion EC is pushing imaginary project of Nabucco pipes with support of drowning USA who’s last straw of Silk Road blocking strategy Nabucco is. EU countries as well non-member states are pushing national interests; Iran, Turkmenistan and Azerbaijan are looking the best deal, Russia tries keep domination of gas markets and secure the resources, EU companies are playing with two cards to secure being with winners side and EP of course is bystander.

More my articles one may find from my BalkanBlog!

Comments